Are Hidden Costs Holding You Back? by Eugene Alexeev

Everything’s about to change once you tackle the hidden fees in IT investments

Hey there, my friend!

Today, we’re diving into something that doesn’t get nearly enough attention – hidden costs in investing.

Trust me, these sneaky little expenses can really take a bite out of your returns if you're not careful.

But don't worry, by the end of this, you'll know exactly what to look out for and how to handle them.

Here’s what we’re going to break down today:

Hidden Costs in Private Equity

Hidden Costs in Stock Investing

Buffett and Munger’s Take on Hidden Costs

Ready? Let’s get into it.

Hidden Costs in Private Equity: The 'Not-So-Free' Lunch

Private equity has its appeal – who doesn’t love the idea of owning a piece of a company on the rise? But there’s more to it than just the allure of potential profits.

Hidden costs can quietly eat away at your returns. Here’s what you need to watch out for:

Management Fees:

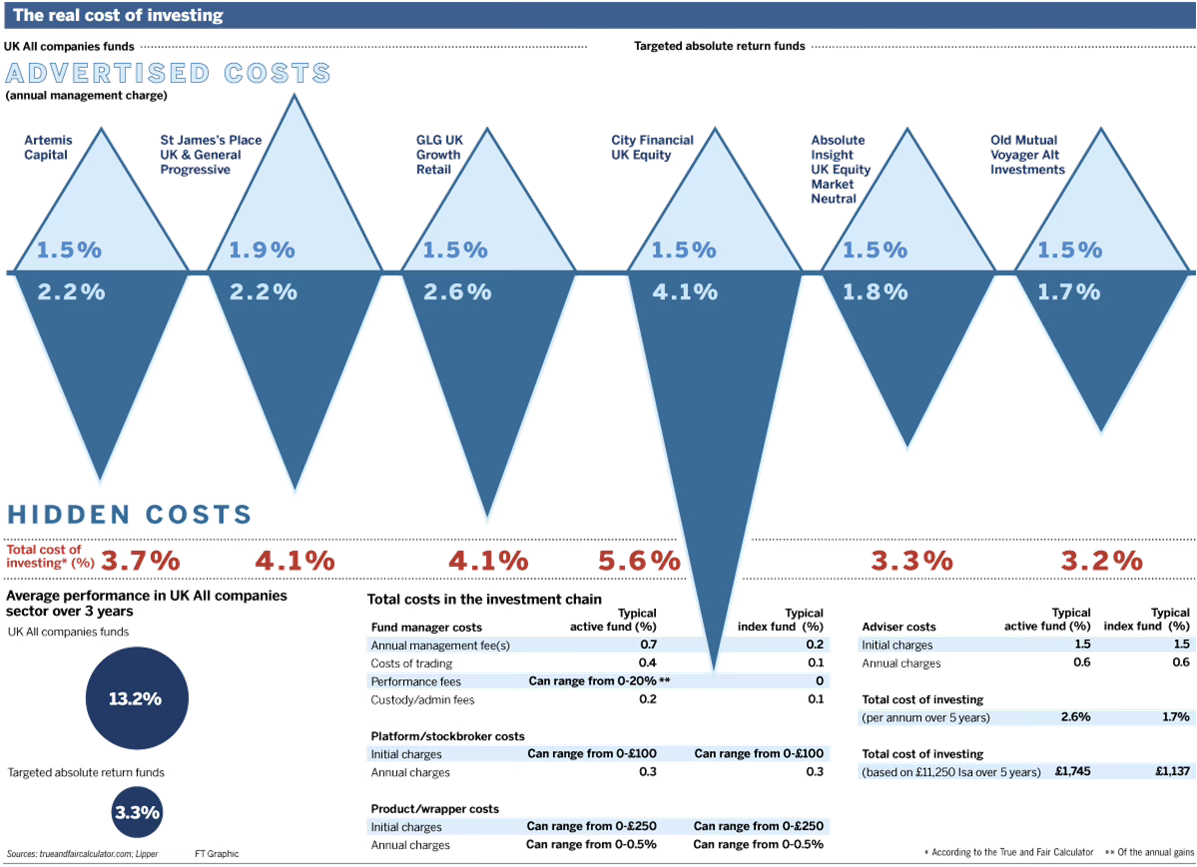

Typically, private equity funds charge around 1.5% to 2% of committed capital annually. Here’s also another report which can help you to understand the situation.

Over the life of a fund (often 7-10 years), that can add up to a substantial amount. It's like a slow leak in a tire – you won’t notice it right away, but eventually, it’s going to leave you stranded on the side of the road.

Carried Interest:

This is the performance fee fund managers take once they hit a certain profit target – usually about 20% of profits above a set threshold.

It's not always included in the upfront cost estimates, so it can be a bit of a surprise if you're not keeping an eye on it.

Monitoring and Transaction Fees:

Think of these as the 'small print' fees – covering everything from travel expenses for board meetings to the costs associated with buying or selling portfolio companies.

They can sneak up on you, quietly chipping away at your returns.

But the real kicker? Many private equity firms aren't exactly transparent about their fee structures, which can make it tricky for investors to get the full picture.

Hidden Costs in Stock Investing: Not as Cheap as It Seems

Stocks might feel like a simpler investment compared to private equity, but they’ve got their own set of hidden costs lurking beneath the surface.

Brokerage Commissions:

Every time you buy or sell stocks, you’re paying a fee. It might seem small at $5 or $10 a trade, but for active traders, these costs can pile up faster than you think.

Expense Ratios:

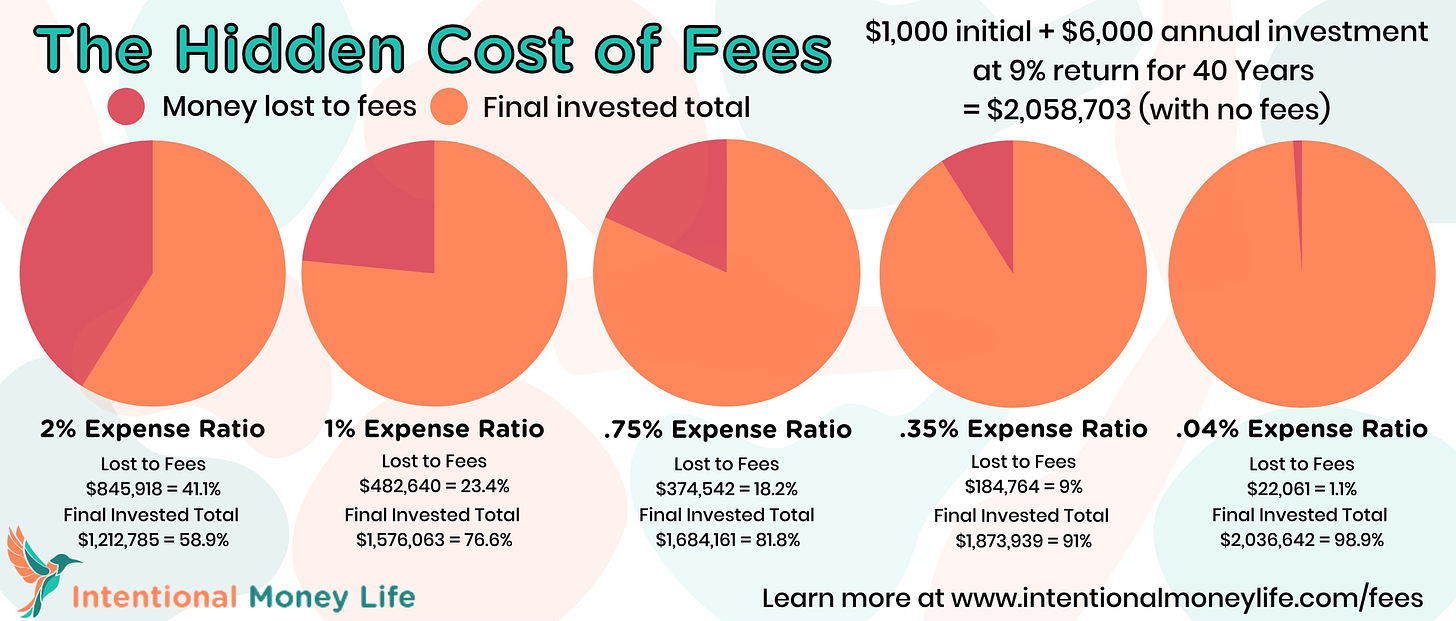

If you’re investing in mutual funds or ETFs, you’re paying for the privilege.

Actively managed funds can charge 1% or more, while passive funds are generally cheaper, but these fees add up over time and slowly eat into your returns.

Bid-Ask Spread:

This is the difference between what buyers are willing to pay for a stock and what sellers are asking for it.

You end up paying more when you buy and receiving less when you sell – a hidden cost that doesn’t show up in any fee breakdown but definitely impacts your bottom line.

Buffett and Munger on Hidden Costs

Now, you’re probably wondering – what do Warren Buffett and Charlie Munger have to say about these hidden costs?

Well, like with most things, they keep it simple: keep your costs low and stay aware.

Buffett’s philosophy is straightforward: “The lower the costs, the greater the net returns.”

He’s a big fan of low-cost index funds for that very reason – minimal fees mean more of your money stays invested and working for you.

He’s always been a critic of high management fees, especially when they don’t bring any added value.

Munger, never one to mince words, often jokes that people pay for what he calls "helpers" – consultants, advisors, brokers – who often don’t provide much real value for the fees they charge.

In his view, the less you pay out in unnecessary fees, the more you can keep in your pocket.

For Munger, it’s all about focusing on the long-term gains and avoiding being "penny-wise and pound-foolish."

Both Buffett and Munger emphasize one thing: always be aware of what you’re paying for, and make sure those costs are justified by real value.

They’d tell you to keep your eyes wide open and avoid getting caught off guard by hidden fees that quietly erode your returns.

Final Thoughts: Keep Your Eyes Open

At the end of the day, investing is about the long game. And part of that game is making sure you know where your money is going.

Hidden costs, while not flashy or exciting, can quietly eat away at your returns over time. It’s all about staying vigilant and not letting these little fees chip away at the big picture.

As Buffett says, "Price is what you pay, value is what you get." Keep an eye on those fees to make sure you're getting the value you expect.

Until next time - keep learning, stay curious, and don’t let hidden costs catch you off guard!

Catch you soon,

Eugene Alexeev

•All information in the article is sharing my own experience and is not a financial advice. It is only for educational and entertaining purposes.

Hello invester

What your work?