Hey there, my friend!

Happy beginning of the week - let’s kick things off with something you’ll enjoy. You know how much I love talking value investing, right?

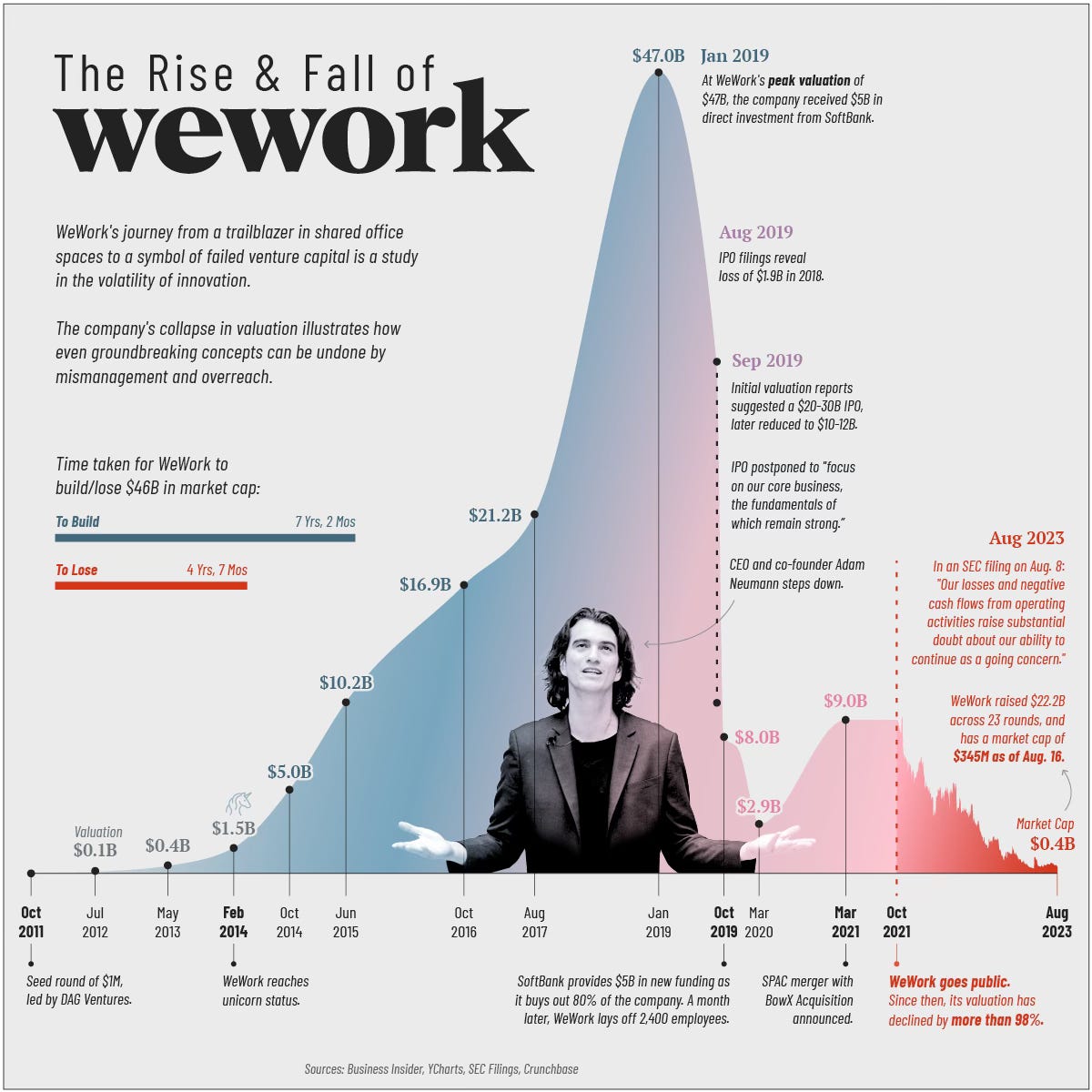

So today, we’re diving into two things: the rise (and fall) of WeWork and how trends play into value investing - whether they should, or shouldn’t. Grab your coffee; this one's good!

In today’s letter, we’ll cover:

Case Study: WeWork - A cautionary tale or a hidden opportunity for value investors?

Trends vs. Value Investing - Should you pay attention to trends, or are they just noise?

Case Study: WeWork - A Cautionary Tale or Hidden Opportunity?

So, WeWork. Yeah, remember them? Shared workspaces, trendy offices, overpriced kombucha? Well, in November 2023, they filed for bankruptcy, again proving that you can’t just sprinkle buzzwords and hope for the best.

But hang tight, because WeWork’s story is far from over. They just inked a restructuring deal with their senior lenders - SoftBank, Yardi Systems, and a few others - securing $450 million in fresh financing.

Pretty bold move for a company that’s been on life support, right?

Here’s the kicker: their restructuring wipes out around $4 billion of debt. Yup, $4 billion! And the lenders?

Well, they’re taking control of the company, with Yardi Systems becoming the new landlord in town. Meanwhile, SoftBank is hanging onto a minority stake, possibly upping their game later.

Classic soft landing - don’t you think? Now, from a value investing perspective, this is where things get interesting.

On the surface, WeWork might seem like a textbook case of what to avoid - a company with a history of reckless expansion, poor governance, and unsustainable cash burn.

But does this restructuring create a new opportunity? Let’s break it down.

Debt Reduction: The restructuring plan wipes out a massive $4 billion in debt. For any value investor, seeing a cleaner balance sheet is a good sign.

Reducing liabilities opens the door for more manageable operations moving forward. But here’s the question: even with a leaner debt load, can WeWork actually generate consistent free cash flow?

That’s the core metric we’d be looking at. Debt restructuring alone doesn’t make a business fundamentally strong - it only buys time.

Ownership Shift: Yardi Systems, a real estate technology firm, is taking the reins. From a governance standpoint, this could be a positive development.

New leadership, especially one grounded in the real estate space, might introduce a more focused operational strategy.

However, there’s still a lack of proven profitability in WeWork’s model. For value investors, a management change isn’t enough - we need to see how this will translate into earnings and, more importantly, value creation over time.

Leaner Operations: WeWork is slashing its operational footprint, going from 650 locations down to 337, focusing on its strongest markets (U.S. and Canada).

This downsizing could help stabilize costs and make the business more nimble. But for any potential value investor, the question is: can WeWork turn those remaining locations into a profitable, cash-generating machine?

Historically, they’ve struggled to monetize their assets effectively.

In essence, while this restructuring might give WeWork a fighting chance, it’s still a high-risk play.

There’s no clear path to consistent profitability yet, and without strong fundamentals, even the cleanest balance sheet won’t create value in the long term.

Buffett’s golden rule applies here: "It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price." WeWork may not yet fit the "wonderful company" mold.

Trends and Value Investing: Do They Mix?

Now, on to something we’ve all asked ourselves: Should we really pay attention to trends when investing in companies?

If you’re a Buffett or Munger fan like me (and if you’re not, you should be), you probably already know where this is headed.

Buffett always says: “Ignore the noise.” And by noise, he means the daily headlines, trends, or what’s “hot” right now.

He focuses on understanding the intrinsic value of a business - its cash flow, competitive advantages, and management team.

Trends? Eh, not so much. And he’s done pretty well by sticking to that.

Munger would probably crack a joke about how investors get distracted by shiny things - like tech buzzwords.

But both agree on one thing: successful investing is about digging into the business, not riding the trend train.

Sure, trends can boost a company in the short term, but if the fundamentals are weak, it’s like putting lipstick on a pig.

That said, can trends play a role in how you scale your business? Absolutely. Companies that can adapt and ride the wave of evolving technology without losing sight of their core strengths tend to come out on top.

Take Apple, for example. They’ve embraced every trend - AI, AR, you name it - while keeping their product ecosystem strong.

But would you invest in them purely because AI is hot right now? No, you invest because Apple prints money, has a killer brand, and a loyal customer base.

Trends are a bonus, not the core reason.

For smaller or mid-sized companies, though, trends can sometimes be make-or-break. If you’re not adaptable, you could end up like BlackBerry - remember them?

Yeah, they didn’t see the iPhone coming. But the key takeaway here is that trends should inform strategy, not dictate your investments.

Look for companies that have the agility to evolve and strong fundamentals. You can’t ignore the economics inside the business.

And that’s it for today, my friend! Hopefully, this gave you something to chew on for the week ahead.

As always, keep learning, stay curious, and don’t be afraid to dig a little deeper into the businesses that catch your eye.

Catch you in the next one!