CEO Succession and Value Investing by Eugene Alexeev

How strategic CEO changes and tech investments drive lasting value

Hey friends!

Let’s kick things off with a topic that doesn’t always make the headlines but has a massive impact on a company’s future - CEO succession planning.

Think of it as the ultimate long game. If you’re like me, you know that in value investing, we’re all about picking companies that are here for the long haul, and who’s in the driver’s seat matters more than we sometimes realize.

So today, I want to talk about why it’s crucial for boards to be ready for the day their top leader hands over the reins - planned or not.

We’ll dive into why this matters, how legends like Buffett and Munger view succession, and highlight some real-world cases where the right (or wrong) transition shaped a company’s future.

Why CEO Succession Matters

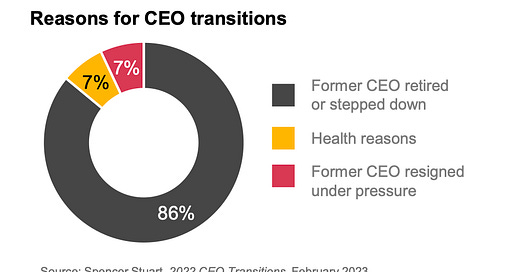

When we’re thinking in decades, not quarters, CEO transitions become critical. Even within the S&P 500, CEO tenure averages barely six years, and turnover has been steadily climbing.

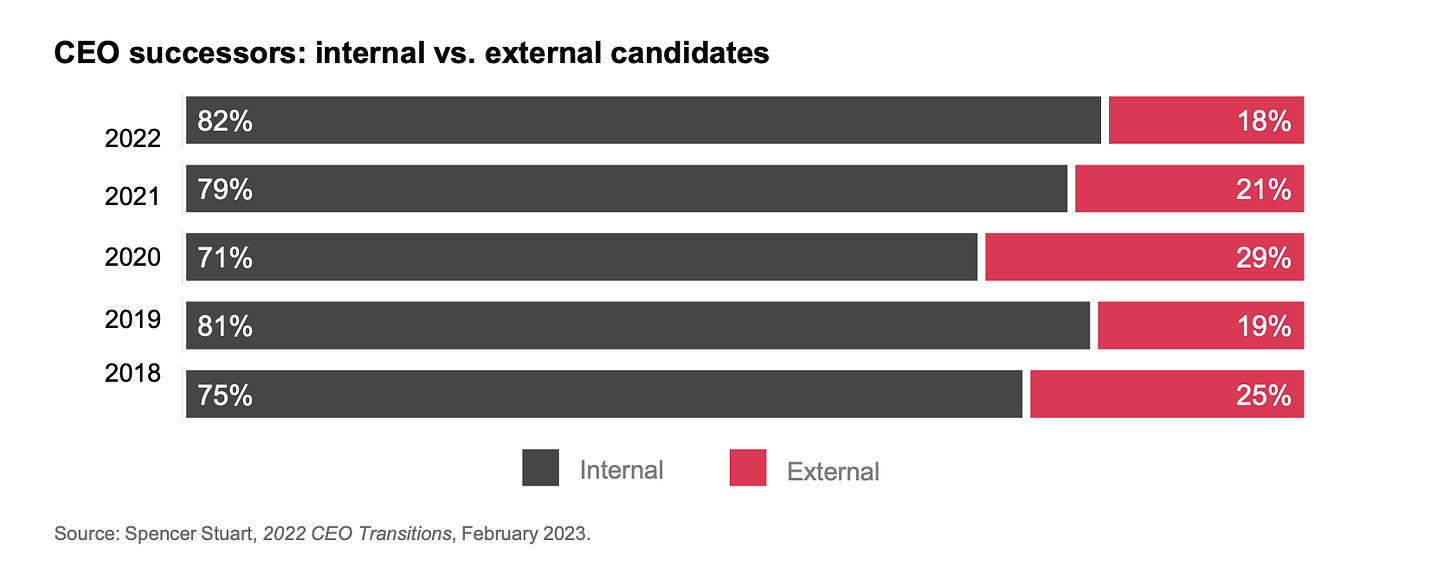

According to PwC’s latest survey, nearly one-third of boards admit they aren’t giving CEO succession planning enough focus - despite it being one of their most critical responsibilities.

Imagine letting one of your best assets - the company’s leadership - go unmonitored. Risky, right?

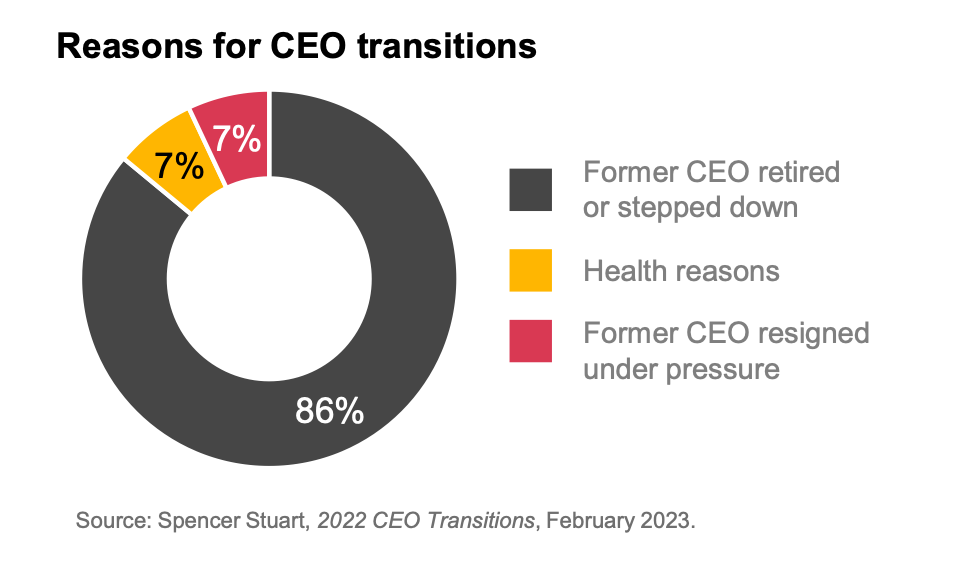

For Warren Buffett and Charlie Munger, one key factor is stability and continuity.

They look for companies where leadership transitions are seamless, often internal, and where the new CEO has grown alongside the company’s culture and long-term goals.

Research shows unplanned CEO successions can cost companies an average of $1.8 billion in shareholder value(pwc-how-the-best-boards…).

No surprise, then, that investors want succession plans that are not just “in the works” but fully operational.

Case Studies: Lessons from Top Companies

Not every CEO transition goes smoothly, and the results can be dramatic. Consider Yahoo’s appointment of Marissa Mayer.

The market initially reacted positively, but a lack of strategic fit soon led to significant stock declines and ultimately, the sale of its core business to Verizon.

Compare this with Microsoft’s careful handover to Satya Nadella. Since Nadella took over, Microsoft’s stock has more than quadrupled, driven by his clear vision for cloud expansion and long-term innovation.

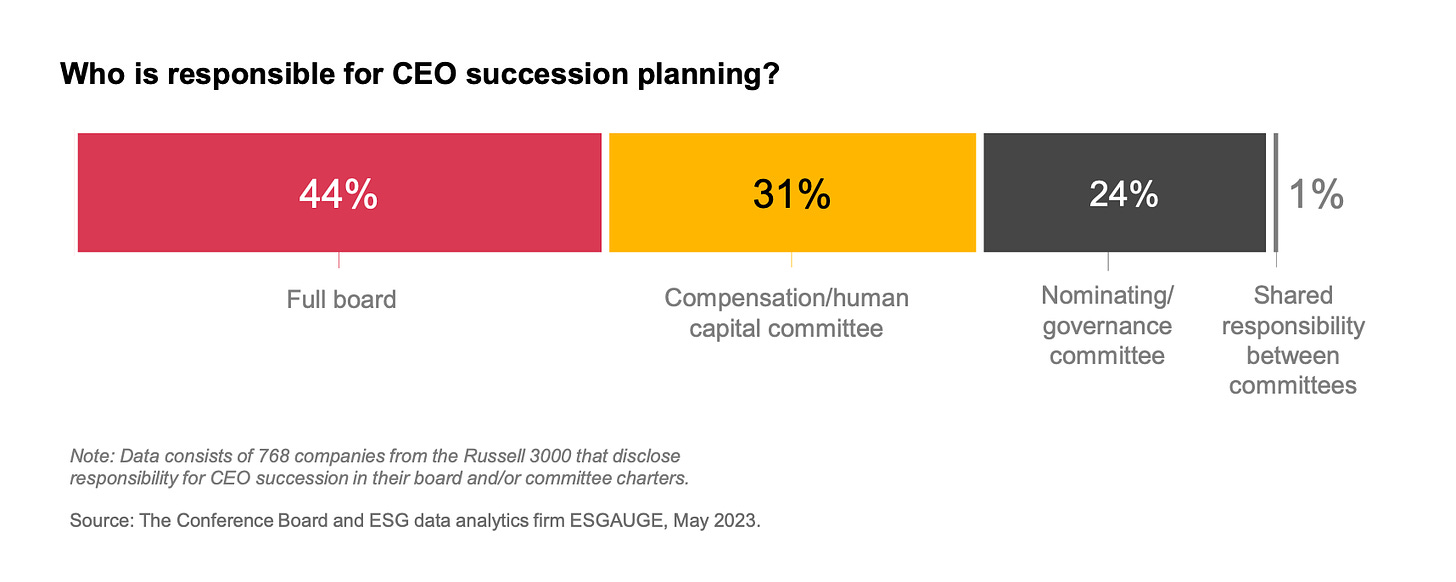

There are also companies like Apple, JPMorgan Chase, and Procter & Gamble that showcase the impact of well-planned successions.

When Tim Cook took over from Steve Jobs, Apple’s board had a meticulous plan in place to ensure smooth continuity.

JPMorgan Chase, meanwhile, has built a strong talent pipeline under Jamie Dimon, who has consistently groomed potential successors, balancing internal growth with fresh perspectives.

What to Look for in Succession Planning

The best boards don’t just wing it. They have documented plans, emergency backups, and a clear approach to balancing internal and external talent.

Companies with proactive succession planning follow nine core practices, according to PwC, which include ensuring a strong and diverse candidate pool, staying data-driven in evaluations, and maintaining a robust pipeline of potential leaders.

With so many potential pitfalls, these best practices are no longer just recommendations - they’re essential for keeping companies on track and avoiding costly leadership missteps.

The Takeaway for Long-Term Investors

Next time you’re evaluating a company, take a moment to consider their approach to CEO succession. Even the best business strategy can fumble if there isn’t a strong leader at the helm during a transition.

Look for companies that are planning not just for today, but for years down the line - those are the ones that have real staying power.

Until next time, keep those long-term goals in sight!

•All information in the article is sharing my own experience and is not a financial advice. It is only for educational and entertaining purposes.